Power Play: Comparing Vehicle Emissions for Mining Companies Considering Electric Vehicle Conversion

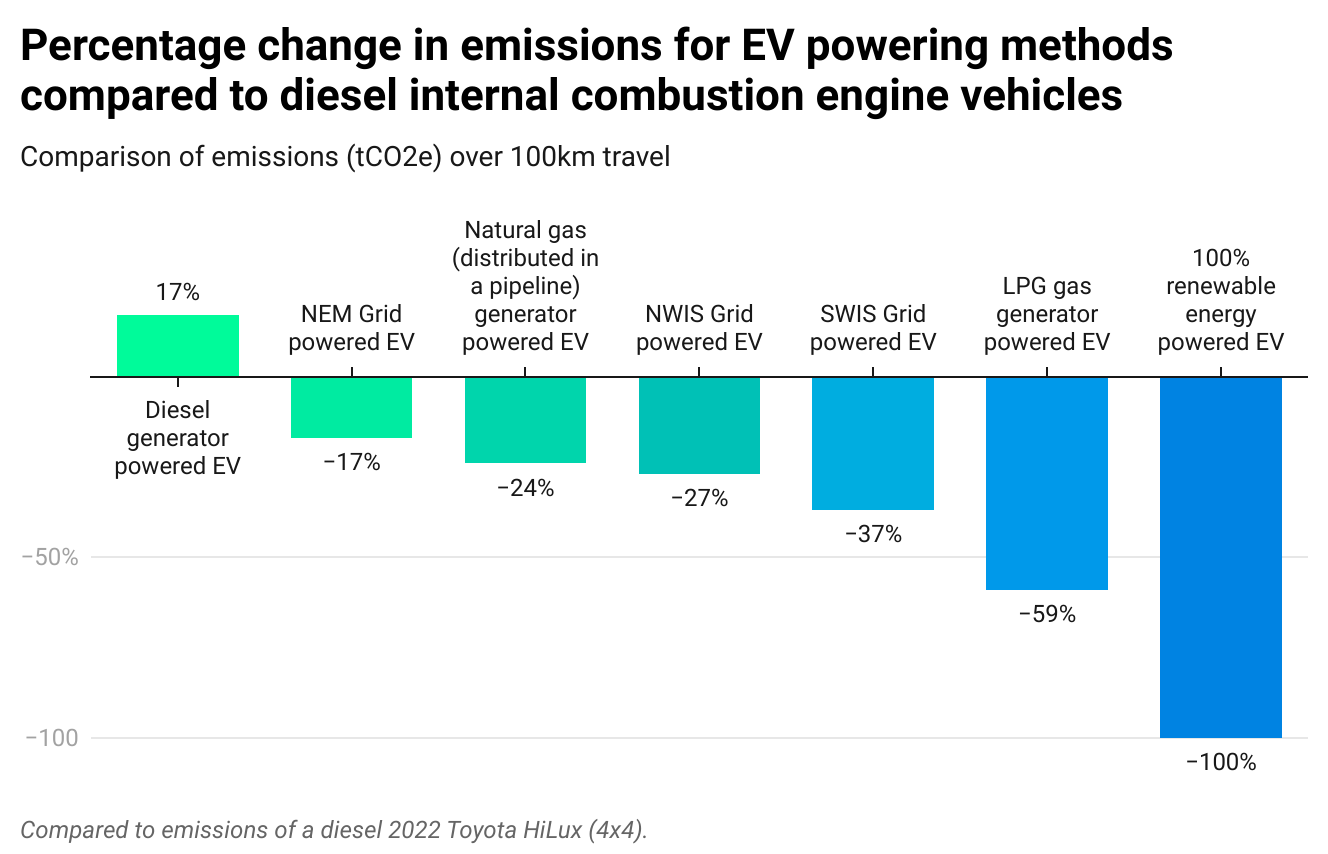

In the global fight against climate change, the mining industry is facing mounting pressure to reduce their carbon emissions and transition towards sustainable practices. One promising solution is the adoption of electric vehicles (EVs) as an alternative to traditional diesel-powered vehicles. New research released by energy and carbon advisors Super Smart Energy has thrown a surprising twist into the equation revealing that trading diesel vehicles for EVs may not be a silver bullet emission reduction solution. This analysis compared emission outcomes of traditional diesel vehicles against EVs charged by various means. It was found that EVs charged by diesel-powered generators produced 17% more emissions than standard diesel vehicles. The additional EV charging mechanisms assessed produced varying emission reduction results. These findings have sparked important considerations for mining companies looking to make the switch to EVs.

Growing interest in electric vehicles conversions

The growing interest in EVs as a potential solution to mitigate emissions in the mining industry has been fuelled by pressure from investors and government as well as public opinion. EVs are widely perceived as a cleaner alternative to traditional diesel-powered vehicles, boasting the potential to dramatically decrease direct tailpipe emissions. This appeal has prompted many mining companies to consider transitioning their fleets to EVs, viewing them as a vital step towards achieving their emissions reduction targets and demonstrating environmental stewardship.

In WA, mining giants have all indicated a pivot to EV fleets with junior miners following suit. As a testament to the strong demand for EVs mining electric vehicle provider MEVCO announced a project with SEA Electric earlier this year to convert 8500 new or near-new HiLux and LandCruiser diesel vehicles into electric cars over the next five years (ABC, 2023). In an ABC article earlier this year the President of Asia Pacific for SEA Electric, Bill Gillespie, reportedly said the demand for electric utes in Australia’s mining sector was huge and had recently ramped up even more (ABC, 2023).

The recent data analysis by Super Smart Energy, uncovering surprising emissions outcomes depending on charging methods, has brought newfound complexity to the EV adoption discourse. The findings demand careful evaluation and context-specific strategies to ensure effective emissions mitigation in the mining sector.

Comparison of emissions outcomes of EV powering sources

To better understand the implications of electric vehicle adoption in the mining industry, a comprehensive data analysis was conducted by Super Smart Energy, focusing on emissions outcomes from different vehicle and charging combinations.

This analysis used the specifications of diesel 2022 Toyota HiLux SR5+ (4×4) as the baseline example of a diesel internal combustion engine vehicle. With a record 64,391 deliveries of the vehicle in 2022, the Toyota Hilux is currently leading the utility vehicle market in Australia (Dowling, 2023). Across a combined city and highway average, the Toyota HiLux consumes 7.9L diesel per 100km travelled (CarExpert, 2023). Emissions outcomes diesel Toyota HiLux have been evaluated against the emissions outcomes of a Toyota HiLux EV conversion fitted with an 88kWh unit capable of up to 380km. The analysis compares various charging options.

Electric vehicles charged by diesel generators: a misstep for mining companies’ mitigation

The most startling finding from the analysis was that electric vehicles charged by diesel-powered generators produced 17% more emissions than diesel vehicles. This result contradicts the notion that EVs are universally cleaner than their internal combustion engine counterparts.

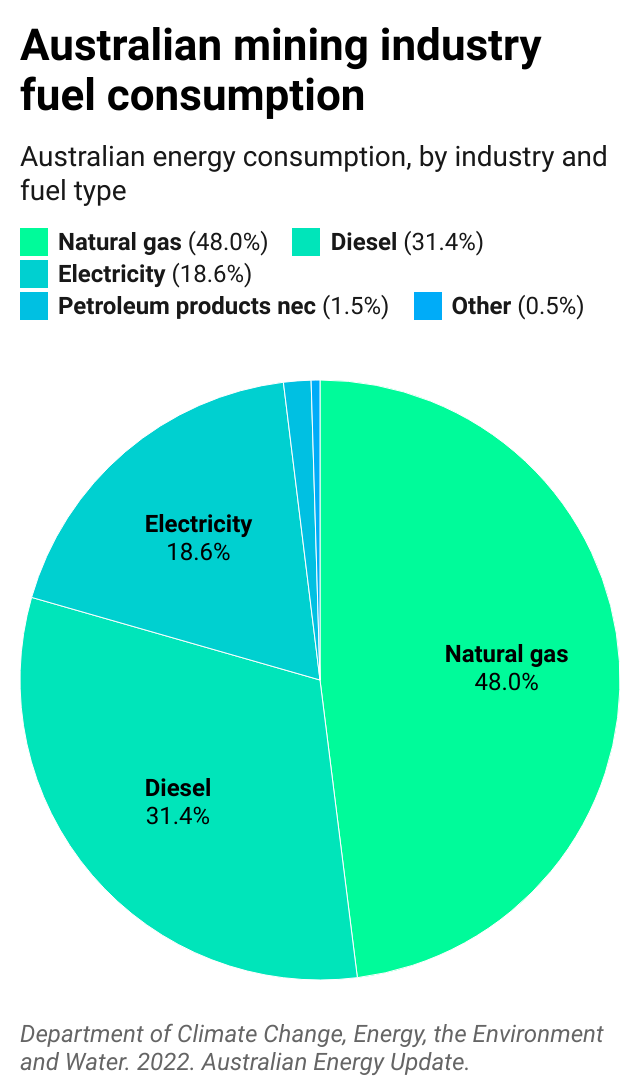

The remote nature of many Australian mines mean they often rely on diesel generators as a source of electricity. The Australian Energy update for 2022 reveals that the mining industry sources 31.4% of its energy from diesel. For these companies, converting to EV vehicles would likely result in increased emissions unless an alternative source of fuel was found.

Charging from cleaner sources

All other charging options for EVs demonstrate varying levels of lower emissions than the standard diesel Toyota Hilux. 100% Renewable energy was the most effective (100% emission reduction), followed by the LPG gas powered generator charging option (59%), grid powered EVs (17% to 37%) and the natural gas-powered generator (24%).

Implications for mining companies’ EV adoption strategy

For mining companies considering the adoption of EVs as part of their emissions mitigation strategy, these findings call for careful evaluation and informed decision-making. A context-specific approach should be taken to carefully assess the charging methods to be employed.

Considering the effectiveness of each fuel type, companies should take into account the additional mitigation that would be required after an EV conversion. For example, an EV fleet powered by a natural gas generator mitigates 24% of the emissions that the standard diesel fleet would have produced. This leaves 76% of the original fleets emissions that still need to be accounted for. The cost to offset this difference can add up with companies trying to offset emissions, with the current Australian carbon credit units price ~$28 (Jarden, 2023).

Companies should also consider the significance of their light vehicle emissions in their overall carbon reduction strategy to assess if EVs are the most cost-effective means of mitigating emissions.

The way forward

In this ever-evolving landscape of emissions reduction, mining companies face pivotal decisions in determining the most effective path towards greener operations. While electric vehicles (EVs) hold immense promise, the new research has uncovered surprising complexities in their adoption. It highlights the importance of carefully considering the energy source of EVs in emissions reduction calculations.

The expert team at Super Smart Energy understands the importance of context-specific solutions tailored to each mining operation’s unique requirements. They are equipped to conduct thorough data analyses to help mining companies make informed decisions that align with their environmental goals while maximizing cost-effectiveness.

References

ABC. (2023). Electric ute conversion targets resources sector in $1b deal to displace diesel. https://www.abc.net.au/news/rural/2023-02-09/sea-mevco-electric-vehicle-mining-ute-toyota-hilux-landcruiser/101896170

Downing, J. (2023). VFACTS December 2022: Toyota HiLux sales highest since Holden Commodore and Ford Falcon two decades ago. Drive. https://www.drive.com.au/news/ute-sales-australia-2022-toyota-hilux-ford-ranger/

CarExpert. (2022). 2022 Toyota Hilux Sr5 (4×4) Specifications. https://www.carexpert.com.au/toyota/hilux/2022-sr5-4×4-5d3771b9

Department of Climate Change, Energy, the Environment and Water. (2022). Australian Energy Update 2022. https://www.energy.gov.au/publications/australian-energy-update-2022

Jarden. (2023). Australian Carbon Credits Units Pricing. https://accus.com.au/

![chuttersnap-xfaYAsMV1p8-unsplash[1]](https://supersmart.energy/wp-content/uploads/2023/08/chuttersnap-xfaYAsMV1p8-unsplash1-scaled.jpg)